Online Checking Accounts Early Access to Your Paycheck, Free Bill Pay, Zelle® and the Perks of a Debit Mastercard

Discover our suite of personal checking accounts: QPlus, QChoice, and QClassic. Each comes with free bill pay, a Debit Mastercard, mobile deposits, overdraft protection services, access to 90,000 ATMs nationwide, and so much more! Choose the one that’s best for you!

The Best Online Checking Account is the One That's Good for You.

Looking for a no-frills, get er’ done checking account with no fees? Or how about an account that gives you a little somethin somethin back each month in addition to ATM reimbursement? At Quorum, we’re all about helping you simplify your daily, personal banking needs. That’s why we designed three checking accounts with your lifestyle and preferences in mind. So the best choice is the one that works best for YOU.

But first, here are all the things that come standard with all of our checking accounts:

- FREE Debit Mastercard®

- FREE Bill Pay service

- Surcharge-free ATMs (90,000+ nationwide)

- Priceless Mastercard® special offers

- Mobile deposits

- Overdraft protection services

QPlus Checking

The premium choice for those who want maximum benefits. This one-of-a-kind checking account allows you to access your paycheck five days early, earn high dividends, and charges zero fees (as long as you meet the account requirements):

- ALL standard checking account features

- 5-Day early access to direct deposits1

- Zero overdraft fees2

- Up to $200 in overdraft protection

- Unlimited ATM fee reimbursements3

- 1.25% APY4 on balances $10,000 and over

Account Requirements: Enrollment in eStatements and minimum monthly direct deposit(s) totaling $500. A $10 monthly fee applies when these requirements are not met.

QChoice Checking

The account for those who want to get more protection, save more in fees, and earn a little extra in dividends. QChoice Checking offers:

- ALL standard checking account features

- Up to $15 in ATM fee reimbursements per month

- Extra overdraft protection when you need it, like Courtesy Pay and monthly reimbursement of Automatic Transfer fees Learn more about our Overdraft Protection Services here

- 2-day early access to direct deposits*

- Earn interest on higher balances. View current rates.

Account Requirements: eStatements and minimum monthly direct deposit(s) totaling $1,000 or minimum average daily balance of $5,000. A $10 monthly fee applies when these requirements are not met.

QClassic Checking

The everyday checking account with no strings attached. QClassic is an easy-to-manage checking solution, with no monthly fees and minimum balance requirements. It’s truly your classic checking account.

- All standard checking account features

- No monthly fees

- No minimum balance requirements

- 2-day early access to your paycheck*

Let’s Talk About Direct Deposit, Free Bill Pay, Electronic Transfers, and More.

Quorum checking accounts come fully loaded with our free digital banking services. In addition to accessing your account, Zelle® transfers and mobile deposits, here are some of the convenient things you can take advantage of:

Free Bill Payment Service

Early Access to Direct Deposit!

Easy Ways to Send or Transfer Money

More Control Over Your Debit Card

Greater Peace of Mind with Overdraft Protection

More Savings Powered by LifeMart

Ready to Start? Here's How:

Apply.

Use our easy, online application to open an account with us.

Choose.

During the application process, you can choose to open any checking or savings product(s) you like.

Fund.

Once you’ve chosen the product(s) you wish to open, you’ll have the opportunity to fund your account(s) before submitting your application.

What is a Quorum membership?

As with all credit unions, in order to take advantage of Quorum’s products and services, you must be eligible to join Quorum. Quorum membership is free and part of our online application.

Learn more about Quorum membership eligibility here.

How long does this application take?

The online application takes less than 5 minutes to complete! Once you submit your application, it may take between 24-48 hours to establish your account.

What do I need to apply?

- You will be asked to provide a valid ID, your SSN, and banking information.

- You must be at least 18 to open an account with us online.

- On average, the application takes about 5 minutes to complete.

Log in.

Log in to your account via online banking.

Click.

Under Open, click on “Checking/Savings.”

Choose.

Select the product you wish to open, then follow the prompts to complete the application.

How many accounts can I open?

There’s no limit to how many online banking accounts you can open!

How much money do I need to deposit?

Minimum deposit requirements will vary depending on the type of account you open. You’ll find account requirements for each account as you go through our online application or in the individual product pages on our website.

Are there additional fees?

QClassic Checking is fee-free! QChoice has account requirements including eStatements, minimum monthly direct deposit(s) totaling $1,000 or a minimum average daily balance of $5,000. A $10 monthly fee applies when these requirements are not met. QPlus has zero fees as long as you meet the account requirements including enrollment in eStatements and minimum monthly direct deposit(s) totaling $500. A $10 monthly fee applies when these requirements are not met.

We’ve Got You Covered with Three Levels of Overdraft Protection****

Nobody wants an overdraft fee or declined charges from an overdrawn account. Although the simplest way to avoid overdraft fees or rejected transactions is to keep a positive account balance and ensure that you have enough money in your account to cover your transactions, we understand that sometimes overdrawing on your account happens.

That is why we offer three types of overdraft protection, so we can help you avoid steep fees, rejected transactions, and other inconveniences that may arise from an overdrawn account.

Checking Reserve Line-of-Credit:

- Log in to online banking

- Click on More, then “Credit Card and Personal Loan Application”

- Click on “Continue"

- Click on "Get a personal loan”

, then "Apply for a Checking Reserve" to start your application

This service is not available for QPlus Checking.

Automatic Transfer:

Courtesy Pay:

How does Courtesy Pay work?

When you charge your checking account for more money than you have available, Courtesy Pay allows us to honor your transaction for a fee of $37 per transaction so you can avoid the inconvenience of returned checks, rejected transactions, and costly fees. And while we cover the overdrawn transactions on your account, you can focus on keeping your account(s) current!

Courtesy Pay will only kick in after all applicable Overdraft Protection options you have available on your account (i.e. Checking Reserve Line-Of-Credit and/or Overdraft Transfers from Savings) have been utilized.

Exception: If you have a QPlus Checking Account, Courtesy Pay will only cover up to $200 in overdrafts. Once you’ve exhausted your $200 overdraft coverage, transactions that would overdraw your account are automatically declined. You will not be charged any overdraft or NSF fees.

What types of transactions does Courtesy Pay cover?

We will cover the following transactions:

- Checks and other transactions made using your checking account number

- Automatic bill payments

- Electronic transfers (ACH debits)

- Recurring debit transactions (e.g., gym membership)

You may also opt-in to extended coverage which allows us to cover the following transactions:

- ATM transactions

- Everyday debit card transactions

Courtesy Pay Considerations:

Overdrafts must be covered within 32 days. Payment of overdrafts are subject to the following dependencies:

- Individual and Account Limits

- Coverage level: Standard vs Extended

Other Helpful Resources:

Questions to Ask Before You Open or Switch Checking Accounts

The Five-S Plan for ATM Safety

The Benefits of Direct Deposit

Frequently Asked Questions

How does a checking account differ from a personal savings account?

Checking accounts allow you to access your money to shop, pay bills or withdraw cash from locations across the globe. They are well-suited to pay for your daily or recurring expenses. A regular savings account, on the other hand, offers the added benefit of earning higher dividends, or a compounded return on the funds you deposit over time. These dividends compound at intervals set by the financial institution, but usually occurs either annually, quarterly, monthly, or daily. (Quorum compounds dividends monthly.)

Savings accounts are, by design, not suited to pay for daily purchases. If your monthly budgeting and bill payment plan requires multiple transfers each month from a savings account, or you believe you may routinely exceed six transfers per month, consider a checking account, or setting up multiple savings accounts.

I’m interested in opening a checking/savings account with Quorum. Do they perform a hard/soft pull credit inquiry when reviewing the application?

A hard pull or soft pull can occur when you open a new checking or savings accounts from an online banking, credit union, or financial institution. A hard pull (which typically happens when a lender checks your credit report to make a lending decision; for instance, when applying for a mortgage) can (temporarily) slightly lower your credit score, and will typically stay on your credit report for two years. A soft pull, on the other hand, is an inquiry performed by a financial institution on your credit report, but does not affect your credit score in any way.

When Quorum reviews a checking or savings account application, we may perform a soft pull on an applicant’s credit report through one of the three major credit reporting agencies (TransUnion, Experian, Equifax) for verification purposes, and also run the name through ChexSystems to see if there is a report in their system. Neither of these actions will impact an applicant’s credit score in any way.

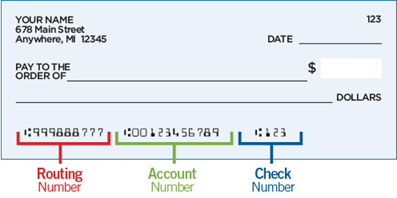

What is Quorum's ABA Routing and Transit Number?

Quorum’s ABA Routing and Transit Number is 221981335.

A routing number is a 9-digit code used to identify financial institutions in electronic transactions. You can always find our routing number in the lower left-hand corner of your checks:

Do you offer Direct Deposit?

Yes! When your electronic deposits—including paychecks and social security payments—are deposited directly into your Quorum checking account, you get immediate access to your money. Your funds are available as soon as they’re deposited.

Whether this is the first time you’re setting up direct deposit or simply want to switch it to Quorum, we make it easy for our members with ClickSWITCH. It takes about two minutes to initiate a switch in online banking. Simply log in to online banking and from the Dashboard, click on “More,” then “ClickSWITCH.” ClickSWITCH will initiate the change with your employer and notify you once the switch is complete.

Refer to How do I set up direct deposit? to get started.

What is Quorum's Early Direct Deposit?

Quorum’s Early Direct Deposit* transfers your paycheck from your employer into your checking or savings account a few days before your actual payday (typically, between 2 -5 days earlier). To take advantage of Early Direct Deposit, you must have direct deposit set up to your Quorum checking or savings account. Once it’s set up, there’s nothing else you need to do: you’ll start seeing deposits earlier than expected!

*Early availability is not guaranteed and may vary from deposit to deposit. Funds availability depends on when we receive the payor’s payment instructions, any limitations we set on the amount of early availability, and standard fraud prevention screening. Eligible deposits are electronic deposits made through the Automated Clearing House (ACH) to your personal account including but not limited to items such as your payroll, pension, and government benefit payments. Other deposits or credits to your account, such as deposits of funds from person-to-person payment services (e.g., Zelle®, Venmo, or PayPal transfers), check or mobile deposits, and other online transfers or electronic credits are not eligible for early availability.

How does Direct Deposit work?

Direct deposit is an automated process commonly used for paychecks, which allows employers to transfer money electronically into your checking or savings account, with no need for a physical or paper check.

Direct Deposit works through an electronic network called the Automated Clearing House (ACH). The ACH network is managed by the National Automated Clearing House Association, a nonprofit association known as NACHA. It administrates the movement of money through the ACH network for all U.S. banks and credit unions.

How do I order QChoice free checks?

If you have opened a QChoice checking account and checks were requested at the time of opening, your free checks and your Mastercard debit card will arrive in five to seven business days.

To order free checks, all you need is our Routing Number (221981335) and your 14-digit MICR account number. This can be found at the bottom of one of your existing checks, or in online banking: from the Dashboard, click on “Accounts” and then select the “Account Details” tab.

If you have moved from another Quorum checking account to a QChoice account, your existing Mastercard debit card and 14-digit MICR account number will remain the same. You can continue to use your current checks or order free checks here.

To receive free checks, please note that you will need to order the specific style for the QChoice Checking; this style is called Sky Blue Alliance.

Can I switch checking accounts?

Can I switch checking accounts?

Yes, it’s easy to switch checking accounts. Follow the steps below to get started:

- Log in to online/mobile banking.

- Click on “More” from the Dashboard, and then “Account Services.”

- Under “More Services,” click “Checking Account Change Request.”

- Complete the form, and then click “Submit.”

Please note, if you are trying to switch to a new QPlus Checking and you have an existing Overdraft Line-of-Credit (Checking Reserve) linked to the checking account you are attempting to switch from, you must close your Overdraft Line-of-Credit (Checking Reserve) and pay off any remaining balance on that account prior to switching to QPlus Checking.

I switched checking accounts types. Will my current ATM card or MICR account number change?

If you switch checking account types, your ATM card and MICR number will not change.

If you request a new checking account suffix, the MICR will change. This may also affect the checking account linked to your ATM Card.

If you need to confirm the checking account linked to your card, please either send us a secure message by logging in to online banking and clicking on “More” from the main menu, then “Message Center,” or contact us at (800) 874-5544, Monday through Friday, 8:30 a.m. to 7:00 p.m. ET.

Are my funds insured with Quorum?

Your Quorum accounts are insured up to $250,000 per person by the National Credit Union Share Insurance Fund (NCUSIF). Individual Retirement Accounts (IRA) are insured separately up to $250,000. The National Credit Union Administration (NCUA), a federal agency, administers the insurance fund and regulates federally insured credit unions. The fund is backed by the full faith and credit of the U.S. Government.

Depending on how your accounts are owned and what types of accounts you have, you can potentially increase the total insurance on your funds to greater than $250,000.

The Share Insurance Estimator, found here, can help you determine whether your accounts are established and insured appropriately. If you have already utilized the Share Insurance Estimator and still have additional questions, you can also reach out to the NCUA Consumer Assistance Center at (800) 755-1030. Representatives are available from Monday through Friday from 8 a.m. – 5 p.m. ET. You can also send an email with your questions to dcamail@ncua.gov.

A Few Things You Should Know

*Early Direct Deposit: Early availability is not guaranteed and may vary from deposit to deposit. Funds availability depends on when we receive the payor’s payment instructions, any limitations we set on the amount of early availability, and standard fraud prevention screening. Eligible deposits are electronic deposits made through the Automated Clearing House (ACH) to your personal account including but not limited to items such as your payroll, pension, and government benefit payments. Other deposits or credits to your account, such as deposits of funds from person-to-person payment services (e.g., Zelle®, Venmo, or PayPal transfers), check or mobile deposits, and other online transfers or electronic credits are not eligible for early availability.

1. 5-Day Early Access to Direct Deposits: This feature is only available for Quorum members with a QPlus Checking Account. In order to establish access to this feature, two direct deposits with an aggregate total of at least $500.00 coming from the same funding source and enrollment in eStatements must be established within 90 days of account opening. It may take two cycles for the early access to direct deposits to take effect. Early Access funds will be credited to your account up to five days prior to the date scheduled by the payor and are subject to change at any time. Quorum does not guarantee that any direct deposits will be made available before the date scheduled by the payor, and early availability of funds may vary between direct deposits from the same payor. Quorum shall have no liability for payments returned as a result of insufficient funds, overdrafts or any other payment failure due to reliance on Early Access funds. Early availability of your direct deposit is not guaranteed and may vary from deposit to deposit. There is a maximum of two direct deposits that will be eligible for Early Access and a maximum of $10,000 per direct deposit will be advanced. In the event an account has more than two different direct deposits, Quorum reserves the right to determine which two are eligible for Early Access. Funds availability depends on meeting the requirements mentioned above and is subject to any additional limitations set on early availability of funds, including, but not limited to standard fraud prevention screening. The criteria we use for making funds available early are determined in our sole discretion, based on confidential criteria necessary for maintaining the security of your account and our payment services and are subject to change without notice. Not all direct deposits are eligible for 5-Day Early Access to Direct Deposits. Eligible deposits are electronic deposits made through the Automated Clearing House (ACH) to your personal account including but not limited to items such as your payroll, pension, and government benefit payments. Other deposits or credits to your account, such as deposits of funds from person-to-person payment services (e.g., Zelle®, Venmo, or PayPal transfers), check or mobile deposits, and other online transfers or electronic credits are not eligible for Early Access. Interest on your incoming direct deposit will begin accruing on the business day we receive credit for the deposit from your payor’s bank. Early Access advance amount will be debited from your account once the direct deposit has posted. Beginning two (2) business days after the deposit date scheduled by the payor, you are responsible for any negative balance that results from the usage of Early Access funds and the subsequent debit in accordance with our Truth in Savings Agreement. Quorum reserves the right to revoke Early Access to funds for any reason and at any time.

2. Overdraft Protection: You will not be charged with any overdraft of non-sufficient funds fees on this account. QPlus Checking comes with two levels of overdraft protection at no cost to you: automatic overdraft transfers and Courtesy Pay. The automatic overdraft transfers feature authorizes Quorum to transfer funds from any of your eligible existing Quorum savings/checking accounts to your QPlus Checking account to cover transactions that cause your account to go negative. Courtesy Pay allows us to consider paying your checks, ACH and recurring debit transactions that overdraft your account up to $200.

3. ATM Fee Reimbursements: ATM fees incurred will be reimbursed and will be automatically deposited into your account on the 2nd business day of the following month.

4. Annual Percentage Yield (APY) is in effect as of 04/01/24 and subject to change. The current APR is 1.24%. APY and APR may change after account is opened. You must maintain a minimum monthly balance of $10,000 in order to earn this APY and rate. Balances under $10,000 will earn the Basic Savings APY and rate. Please refer to our rate sheet for current APY and rates.