Checking and Savings Accounts Good for your Wallet!

We offer simple and transparent checking and savings products that are easy to choose from.

Checking Accounts

For your daily banking needs, we have two checking accounts with 2-day faster access to your paycheck* that you can choose from—QClassic, our standard, free checking account with no monthly fees and no minimum balance requirements and our QChoice, a dividend-earning checking account that has all the features of the QClassic account.

Savings Accounts

For your short- or long-term savings goals, our high-yield liquid savings and top-of-market term accounts (similar to CDs) can help you get there in no time.

The Path to Your Financial Goals Starts Here.

Welcome to your new number-one source for great banking products and services. From checking and savings accounts to market-leading mortgage rates, Quorum has it all covered.

High Yield Savings Products

Whether you want to invest in a fast-moving, high-yield account or a slow-and-steady fixed-rate term account, Quorum offers competitive rates on the savings products you need to get you to the finish line.

Amazing Checking Accounts

Enjoy Quorum’s free, online and mobile bill payment service, mobile deposits, the incredible perks of a Debit Mastercard®, three types of overdraft protection services, access to over 90,000 ATMs nationwide, and so much more!

Move Your Money. Transfer funds between accounts, send money abroad, deposit checks into your Quorum account - move your money however you please.

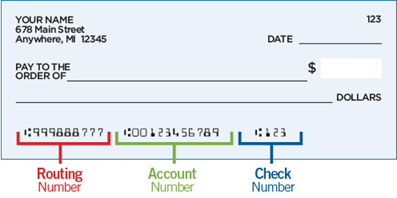

Direct Deposit. Whether this is the first time you're setting up direct deposit or simply want to switch it to Quorum, we make it easy for our members with ClickSWITCH.

Bill Pay. This free service lets you manage and pay your bills in one place. Receive**, view and pay your bills online or via your mobile device.