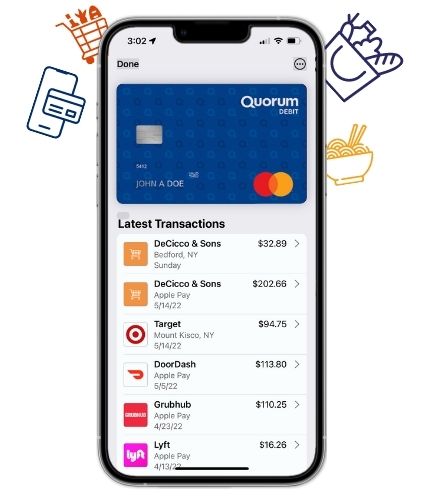

Enjoy the Perks of a Quorum Debit Mastercard® Over 90,000 fee-free ATMs nationwide!

Use your Quorum Debit Mastercard® for all of your shopping needs. All our personal checking accounts come with a Quorum Debit Mastercard® that you can add to your mobile wallet for online or in-store purchases.

Zero Liability: With Quorum's Debit Mastercard, you’re not responsible in the event that someone makes unauthorized purchases with your card.

Purchase Assurance: Peace of mind knowing that most items you purchase are covered if they are damaged within 90 days of buying them.

Extended Warranty: Double an eligible item’s original warranty for a maximum of 24 months (applicable of the original warranty is 24 hours or less).

Price Protection: Purchases you make with your card are covered for 60 days from the date of purchase for the difference between the price you paid and the lower price advertised.

Access to Over 90,000 Fee-Free ATMs Nationwide!

We have a network of over 90,000 fee-free ATMs throughout the country; many ATMs even accept deposits!

We participate in Shared Branching and ATM networking to allow you hands-on, in-person access to your Quorum accounts at no additional cost. View our nationwide network of over 90,000+ fee-free ATMs and 5,000 Shared Service Centers.

We have a network of over 90,000 fee-free ATMs throughout the country; many ATMs even accept deposits!

We participate in Shared Branching and ATM networking to allow you hands-on, in-person access to your Quorum accounts at no additional cost. View our nationwide network of over 90,000+ fee-free ATMs and 5,000 Shared Service Centers.

How to Use Your Quorum Debit Mastercard Internationally

Quorum does not charge additional fees if you use your debit card for international transactions. However, Mastercard charges a foreign conversion fee of 1% per transaction.

If you are traveling abroad and plan to use your Debit Mastercard, please notify us by logging into online banking. Click on “More,” then “Card Management” then click on the card you wish to use abroad. Click on “Travel Notice” to add the dates of your travel. Any challenges, let us know at (800) 874-5544, Monday through Friday, 8:30 a.m. to 7:00 p.m. ET.

Please also keep our Cardholder Services number handy for service 24 hours a day, seven days a week, should you experience any interruption in service during your trip:

Domestic Cardholder Services: (888) 918-7313

Other Helpful Resources:

The Benefits of Using a Debit Card

Credit Vs. Debit: Which Card Is Best?

Savings Interest Calculator

Why Choose Quorum?

Member Reviews

CLOSEJoin an online community geared towards helping your financial well-being through top-tier financial tools, competitive rates, and award-winning customer resources. Become a member today and find out why Quorum is consistently selected as one of the top credit unions in the country.

Frequently Asked Questions

What services are provided under the Personal Identity Theft Resolution Services?

Here are some of the FREE services you can take advantage of:

- Concierge Level Certified Restoration specialist who works autonomously on your behalf to process necessary documentation and dispute resolutions.

- Limited Power of Attorney (LPOA) to represent you during an identity theft event.

- Multiple Tri-Bureau credit reports pulled at no cost to you to help ensure a complete resolution of the identity theft event and restoration of your identity.

- Assistance from a Specialist with cancelling your credit/debit card(s), membership cards, affinity cards and more in the event that identity theft has occurred.

- Ongoing communication with Specialist about the most current status of your fraud investigation until the identity theft situation is successfully resolved to a pre-victim status.

- Access to a Specialist who disputes with the consumer reporting agencies on your behalf to ensure that no fraudulent information negatively affects his or her consumer report information or history.

For a complete list of services please view your Mastercard Guide to Benefits here.

What does Zero Liability protection mean?

You don’t have to worry when you use Quorum Debit Mastercard because, like all MasterCard cards, it’s covered by Zero Liability protection whether you pay in a store, over the phone or online. As a cardholder, you’re not responsible in the event that someone makes unauthorized purchases with your card. Pay only for purchases which you have authorized on your card. Unauthorized purchases are not your responsibility. Conditions and exceptions apply. For details, click here.

What is Mastercard's Global Service

MasterCard Global Service™ provides worldwide, 24-hour assistance with Lost and Stolen Card Reporting, Emergency Card Replacement, and Emergency Cash Advance.

Call MasterCard Global Service immediately to report your card lost or stolen and to cancel the account. If you need to make purchases or arrange for a cash advance, with your issuer’s approval, you can receive a temporary card the next day in the United States, and within two business days almost everywhere else. Remember, if you report your card lost or stolen, you will not be responsible for any unauthorized transactions on your account. In the United States (including all 50 states, the District of Columbia, the U.S. Virgin Islands, and Puerto Rico) and Canada, call 1-800-307-7309. When out-of-country and in need of assistance, you can easily reach a specially trained MasterCard Global Service Representative who can help you 24 hours a day, 365 days a year, in any language. You can call toll-free from over 80 countries worldwide.

For additional information, or for country-specific, toll-free telephone numbers not listed above, visit www.mastercard.com or call the United States collect at 1-636-722-7111.

Account Information and Card Benefits: When in the United States, contact your card issuer directly for account information and 1-800-MC-ASSIST for card benefits. When traveling outside the U.S., call MasterCard Global Service to access your card issuer for account information or to access any of your card benefits.

What is Mastercard's Airport Concierge?

With Mastercard Airport Concierge, you can arrange for a personal, dedicated Meet and Greet agent to escort you through the airport on departure, arrival or any connecting flights at over 450 destinations worldwide 24/7/365. There are also certain airports where you can even be expedited through the security and/ or the immigration process.

To reserve MasterCard Airport Concierge services in advance and to take advantage of the 15% savings, visit www.mastercard.com/airportconcierge for reservations, pricing or additional information. Visit www.mastercard.com regularly for program updates and to learn about special promotional travel offers designed for Quorum debit card cardholders. Or, for more information on these travel benefits, call the number on the back of your Quorum debit card.

To view your Mastercard Guide to Benefits, click here.

How do I file a claim for the Satisfaction Guarantee benefit?

Call 1-800-MC-ASSIST to request a claim form.

- You must report the claim within sixty (60) days of the date of purchase and be prepared to submit the following documentation within one hundred and eighty (180) days of the date you report the claim:

- Completed and signed claim form.

- Receipt showing the purchased item(s).

- Statement showing the purchased item(s).

- Itemized purchase receipt(s).

- Written documentation from the store manager or equivalent on store letterhead documenting the refusal to accept the returned item.

- A copy of the store’s return policy.

- Any other documentation that may be reasonably requested by us or our administrator to validate a claim.

You must send the item to us or our administrator before any claim will be paid. Item must be returned in its original packaging along with the original owner’s manuals and warranty information. You are responsible for all mailing or shipping costs to us or our administrator. Items sent to us or our administrator will not be returned to you.

How do I order a new ATM/Debit Card?

To order a new debit card, simply follow the steps below:

- Log into online banking at quorumfcu.org.

- Select “More” from the Dashboard.

- Select “Additional Services.”

- Select “Checking Account Services.”

- Select “Request a new card” and follow the steps to complete the form.

- Select “Debit Card Replacement,” verify your personal information, and click “Submit.”

You will receive your card in approximately seven business days. You can contact our Member Service Team at (800) 874-5544, Monday through Friday, 8:30 a.m. to 7:00 p.m. ET to request a new card.

What is my PIN for my debit card?

At the time of activation, you will be able to set your own PIN.

If you are an established cardholder and you do not know your PIN, call (866) 985-2273. To expedite the process, please be sure to have your debit card available. Also, please ensure you are calling from a phone number we have on file for you.

How do I change my ATM/Debit Card PIN?

To change your ATM/debit card PIN, you will need to call Cardholder Services at (866) 985-2273 from one of the phone numbers we have on file for you. You will need your card number and the last four digits of the primary member’s Social Security number.

Can I use my ATM/Debit Card internationally?

Yes, you can use your ATM/debit card internationally. Quorum does not charge additional fees if you use your debit card for international transactions. However, Mastercard charges a foreign conversion fee of 1% per transaction.

If you are traveling abroad and plan to use your Mastercard debit or credit card, please contact us to let us know at (800) 874-5544, Monday through Friday, 8:30 a.m. to 7:00 p.m. ET.

Please also keep our Cardholder Services number handy for service 24 hours a day, seven days a week, should you experience any interruption in service during your trip:

- International Cardholder Services: (727) 299-2449

- Domestic Cardholder Services: (888) 918-7313

Why was my debit/credit card purchase declined?

If your debit/credit card purchase is declined, please contact our Member Service Team at (800) 654-7728, Monday through Friday, 8:30 a.m. to 7:00 p.m. ET.

How do I activate my ATM/Debit Card?

To activate your ATM/Debit Card, please contact Cardholder Services at (866) 985-2273. You will need to call from one of the phone numbers we have on file for you and you will need your card number to complete activation.

If your ATM/debit card does not have a Mastercard logo on it, your card does not require activation.

What's the difference between a debit card and an ATM card?

A debit card is linked to your checking account and draws from the available money within the linked account. Your debit card can be used for point of sale transactions, PIN transactions and ATM withdrawals. When you use your debit card, funds are immediately withdrawn.

An ATM card can only be used at an ATM terminal to withdraw or deposit money. On rare occasions, certain merchants may accept ATM transactions.