After the Supreme Court blocked the Education Department’s student debt cancellation plan in June, the department announced its latest student loan overhaul: a new income-driven repayment plan called SAVE (Saving on A Valuable Education). The exact details of the new plan can be confusing, especially when the parameters and rollout dates keep changing. Here, we’ve broken down the plan into simple terms and outlined the steps you may need to take.

What is SAVE?

Income-driven repayment plans are based on a borrower’s discretionary income, and not on the amount borrowed. Payments typically do not cover all the interest that accrues. After a specific number of payments, the remaining balance is forgiven.

SAVE, the new IDR plan, features the most generous student loan repayment plan yet. Most significantly, the plan raises the amount of income not counted as discretionary income from 150% of the federal poverty guideline to 225%. It also includes the following benefits:

- Borrowers earning less than $32,805 individually, or less than $67,500 for a family of four, would see $0 monthly bills.

- Students who borrowed less than $12,000 would see their outstanding balance wiped away after just 10 years of payment.

- Most other borrowers would see their payments cut by at least half. If the loan is an undergraduate loan only, the borrower will pay 5% of their discretionary income. If there are some graduate loans mixed with the undergraduate loans, the borrower will pay 5-10% of their discretionary income.

When will SAVE go live?

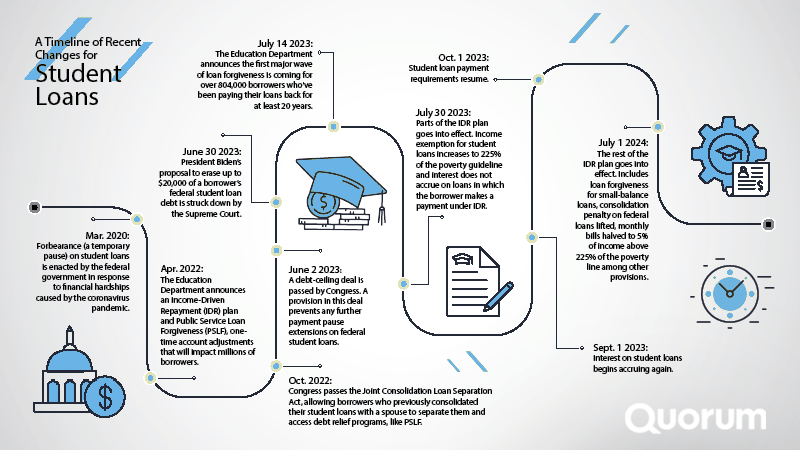

Parts of the new plan have already gone live this summer ahead of the end of forbearance. With all loan payments set to resume on Oct. 1, 2023—and interest building again from Sept. 1—borrowers are encouraged to apply for an IDR plan now. It may take a few weeks to process your application, so it’s important to do it as soon as possible. If your application is accepted, you should see the difference as soon as payment resumes in the fall.

The following SAVE benefits are already available:

- Additional income protection. Income exemption has been raised from 150% to 225% of the poverty line.

- Interest won’t accrue. Unpaid interest will not accumulate if monthly payments are met.

- Benefits for some married borrowers. Spousal income for borrowers who are married and file separate taxes will be excluded from IDR payment calculations. Also, spouses are no longer required to co-sign an IDR application.

Additional benefits will not go live until July 2024:

- Monthly bills halved from 10% to 5% of income above 225% of the poverty line.

- Loan forgiveness applied for smaller loans ($12,000 or less) for borrowers who have been making payments for a minimum of 10 years.

- Consolidation penalty lifted for borrowers who consolidate their federal loans. These loans will no longer lose progress toward IDR loan forgiveness.

- Automatic credit toward IDR forgiveness applied to borrowers’ accounts for specific periods of deferment and forbearance.

- Make up for missed payments allowed for borrowers to receive credit for all other periods of deferment or forbearance that don’t qualify for automatic credit.

- Automatic enrollment in an IDR plan for borrowers with default risk, or payments at least 75 days late, if they previously agreed to give the Education Department access to their tax information.

How will the IDR plan differ from the existing plans?

The new plan will be a direct replacement of REPAYE, one of the current IDR plans.

While there are many similarities, repayment choices under the new SAVE plan are simpler. In addition, as mentioned above, the protected income amount has been raised significantly. Also, the monthly payments will be halved.

Let’s take a look at a true-to-life example to illustrate the differences between existing and new plans.

A family of four with an income of $75,000 has a discretionary income of $30,000, according to the 2023 U.S. federal poverty guidelines. Payments under the current IDR plans are 10% of that amount. Monthly, that would amount to a discretionary income of $2,500 a month, and a monthly payment of $250 toward student loan debt. With the new plans in place, and the threshold for discretionary income now at 225%, the same family would see payments based on only $7,500 of their income, or $625 a month. With payments also now halved to just 5% of this number, this family would only pay $31 a month toward their student loan debt.

How do I apply for the new IDR plan?

If you have an open federal student loan and are interested in applying for the new SAVE plan, contact your student loan servicer and submit an IDR application on the studentaid.gov website. If you are already enrolled in REPAYE, your plan will automatically be transferred to a SAVE plan when it rolls out.

The new SAVE plan can seem confusing to student loan borrowers, but this guide can help you work through the details and learn what you need to know about the new plan.

Comments Section

Please note: Comments are not monitored for member servicing inquiries and will not be published. If you have a question or comment about a Quorum product or account, please visit quorumfcu.org to submit a query with our Member Service Team. Thank you.